XRP Price Prediction: Analyzing the Path to $5 Amid ETF Speculation and Technical Breakouts

#XRP

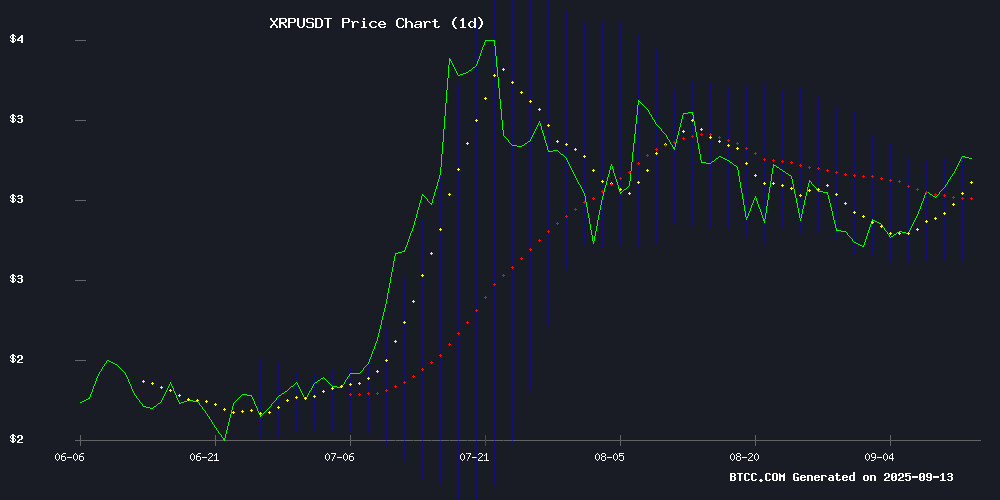

- Technical indicators show XRP trading above key moving average with Bollinger Band breakout potential

- ETF approval speculation and analyst price targets ($4-$5.85) driving bullish market sentiment

- Mixed signals from institutional whales suggesting caution at current resistance levels

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

XRP is currently trading at $3.1149, positioned above its 20-day moving average of $2.9071, indicating underlying strength in the current uptrend. The MACD reading of -0.0118 | 0.0622 | -0.0740 suggests potential momentum building despite the negative histogram. Notably, the price is trading NEAR the upper Bollinger Band at $3.1190, which often acts as a dynamic resistance level. According to BTCC financial analyst Mia, 'The technical setup shows XRP testing crucial resistance levels. A sustained break above $3.12 could open the path toward $3.30-$3.60 targets in the near term.'

Market Sentiment: ETF Speculation Drives XRP Optimism Amid Whale Caution

Market sentiment surrounding XRP is predominantly bullish, fueled by speculation around potential ETF approvals and analyst predictions targeting $4-$5.85 price levels. However, BTCC financial analyst Mia notes that 'while retail enthusiasm is evident through presale participation and bullish technical signals, institutional players show more caution with whales betting against the ETF hype at key resistance levels.' The mixed sentiment reflects the ongoing battle between ETF Optimism and technical resistance challenges, creating a complex market dynamic for XRP investors.

Factors Influencing XRP's Price

XRP Price Targets $4 as Expert Reveals Likely Timeline for Ripple ETF Launch

XRP has surged 12% this week amid a broader crypto market recovery, reflecting growing trader confidence. Optimism around a potential Ripple ETF approval has further buoyed sentiment, though the delayed REX-Osprey XRP ETF launch has sparked community speculation. Market experts now suggest a revised timeline, easing concerns among investors.

The anticipation of an XRP ETF has already influenced price action, with the token briefly consolidating below $3 before renewed bullish forecasts emerged. Analysts project a $4 price target, citing institutional interest and the ETF's potential to unlock new capital inflows. The delay in regulatory approval appears temporary, with industry watchers expecting clarity soon.

Will XRP Hit $5.85 Soon? Top Analyst Sees Biggest Rally Since 2017

XRP has surged past $3.17, marking a 5% daily gain, as trading volumes exceed $6.44 billion. Crypto analyst Dark Defender suggests the token has broken free from an 8-year consolidation phase, echoing its 2017 breakout but on a larger scale.

A decade-long "cup" pattern has been breached, with XRP retesting and holding key resistance levels. Dark Defender's long-term targets include $5.85, $18.22, and $36.76, though these projections extend beyond immediate horizons.

XRP Bulls Target $5 as Ozak AI Presale Draws Retail Investors

XRP's steady climb toward $3 fuels institutional optimism, with technical analysis suggesting a path to $5 by 2025. The asset currently faces resistance at $3.20, $3.50, and $3.80, while finding support at $2.80, $2.60, and $2.40.

Meanwhile, retail investors are flocking to Ozak AI's presale, priced at $0.01, which has already raised $2.9 million. The project's hundredfold return potential highlights the growing divide between institutional and retail crypto strategies.

XRP Price Surges Above $3.10 as Bullish Technical Signals Strengthen

XRP climbed 2.19% to $3.13 as technical indicators flashed strong bullish signals. The RSI at 60.97 suggests healthy momentum without overbought conditions, while the MACD crossover at 0.0180 confirms positive divergence. Trading near the Bollinger Band upper resistance at $3.12, the cryptocurrency shows potential for a breakout.

No major news catalysts drove the move—instead, XRP's momentum reflects broader market sentiment and its sustained position above key support levels. The 200-day moving average at $2.50 underscores the asset's entrenched uptrend throughout 2025.

XRP Eyes $3.60 Amid ETF Approval Speculation

XRP's price trajectory is drawing attention as it breaches the $3.05 resistance level, with analysts projecting a potential climb to $3.60. The rally is fueled by mounting speculation around the approval of an XRP-focused exchange-traded fund (ETF), now pegged at a 92% probability by Polymarket—a 21% surge in confidence since earlier this year.

Institutional interest appears to be growing, evidenced by rising futures volume and open interest. An ETF approval could unlock broader access to XRP beyond crypto-native platforms, potentially accelerating institutional capital inflows and sustaining long-term demand.

Market watchers note two possible paths: a continuation toward $3.60 or a brief retracement to $2.90 before resuming upward momentum. The outcome hinges on whether the current bullish sentiment holds.

Whales Bet Against XRP ETF Hype as Price Faces Key Resistance

XRP struggles to break through the $3.05-$3.15 resistance zone despite a 7% weekly gain, with whale activity signaling caution. Institutional inflows have dwindled, according to CoinShares data, while large holders continue profit-taking after the token's all-time high of $3.65.

The launch of the REX-Osprey XRP ETF fails to inspire whale confidence, with 40 million XRP sold in 24 hours and a $52 million transfer to Coinbase. Market sentiment remains divided as analysts watch for potential movement toward $3.6 amid broader crypto market recovery.

Bearish Divergence Clouds XRP Rally Amid Institutional Inflows

Ripple's XRP surged nearly 10% this week, mirroring broader crypto market gains, as institutional interest through CME futures contracts reached a 10-day high. Open interest hit 384,500 contracts, signaling growing confidence among professional traders.

Long-term holders are holding firm, with XRP's Liveliness metric dropping to a 52-day low of 0.81—a sign of reduced selling pressure from dormant wallets. This metric, tracking coin movement, suggests accumulation among patient investors.

Technical indicators flash warning signs despite the optimism. A bearish divergence threatens to undermine the rally, creating tension between institutional demand and potential market exhaustion. The Chicago Mercantile Exchange's growing XRP derivatives market adds structural support, contrasting with retail-driven volatility.

Will XRP Reclaim a Top 5 Spot by End of 2025? Market Analysts Weigh In

XRP, the native token of Ripple Labs, remains one of the most recognizable cryptocurrencies globally, currently ranking as the third most famous digital asset by market prominence. Despite fierce competition from Layer 1 blockchains, its outlook has brightened considerably this year—bolstered by Ripple's partial legal victory against the SEC.

Trading at $3.05 with a $181.88 billion market capitalization, XRP shows mixed technical signals. While moving averages suggest bullish momentum, MACD indicators hint at potential near-term bearish pressure. Resistance sits at $3.0751, with analysts eyeing $4 as an upward target if breached.

Market sentiment appears overwhelmingly positive, with 88% of traders forecasting continued growth. The coin's high-profile status and improved regulatory clarity could fuel its ascent toward reclaiming a top-five market cap position by 2025.

XRP Price Prediction: Targeting $3.30 by Month-End as Ripple Breaks Key Resistance

XRP's bullish momentum above the $3.02 trendline has analysts eyeing a short-term target of $3.30. The breakout signals potential for further gains, with technical indicators suggesting strong upward potential. Market sentiment remains cautiously optimistic as Ripple defies broader crypto market trends.

Technical setups reveal a critical juncture for XRP, now trading at $3.12. The $2.92-$2.99 support zone must hold to maintain bullish momentum. Analysts diverge on near-term projections, with CoinEdition forecasting $3.20-$3.30 while Changelly warns of potential bearish pressure from the 50-day moving average.

Elliott Wave theory suggests XRP remains in impulse wave [C], supporting medium-term targets of $3.07-$3.20. The cryptocurrency's performance this month could set the tone for Q4 2025 as institutional interest in payment-focused assets grows.

Digitap Launches Omni-Bank Fintech App, Challenging XRP's Dominance in Payments

Digitap has unveiled a crypto-fiat superapp that merges traditional banking with decentralized finance tools, targeting the $290 trillion cross-border payments market projected by 2030. The platform offers instant cash services, IBAN accounts, payroll solutions, and DeFi integrations—all accessible via a mobile app gaining rapid traction on Google Play.

The project's TAP token staking mechanism provides governance rights, cashback rewards, and feature early access. With its presale underway, analysts suggest Digitap could disrupt legacy players like Ripple, particularly as XRP faces regulatory delays with its spot ETF applications.

Unlike single-purpose payment coins, Digitap combines blockchain's borderless architecture with fiat gateways—a hybrid approach resonating with users seeking both crypto innovation and traditional finance stability. The timing appears strategic as regulatory uncertainty continues to plague established payment tokens.

XRP Approaches Key Technical Level as Analyst Outlines Two Potential Price Paths

XRP is testing a critical juncture as technical analysis reveals diverging potential outcomes. The cryptocurrency has broken out of a descending channel on the 4-hour chart, confirming bullish momentum first identified by analyst EGRAG Crypto. Current price action above $3.00 validates the pattern, with $3.12 emerging as the next target.

Market structure remains bullish so long as XRP holds above $2.973, though traders are watching several safety nets including the 21 EMA at $2.957 and 100 EMA at $2.912. The ascending triangle formation suggests accumulating pressure for upward movement, characteristic of continuation patterns before significant breakouts.

Is XRP a good investment?

Based on current technical indicators and market sentiment, XRP presents a compelling investment opportunity with measured risk. The cryptocurrency is trading above its 20-day moving average with strong bullish momentum, while ETF speculation continues to drive positive sentiment. However, investors should be aware of key resistance levels and mixed institutional signals.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $3.1149 | Neutral |

| 20-day MA | $2.9071 | Bullish (Price above MA) |

| Bollinger Upper | $3.1190 | Resistance Test |

| MACD Histogram | -0.0740 | Caution |

| Key Resistance | $3.12 | Breakout Watch |

BTCC financial analyst Mia suggests: 'XRP's investment appeal hinges on breaking above $3.12 resistance. Successful突破 could target $3.60, making it a good risk-reward opportunity for bullish investors.'